Zurcher Kantonalbank, a major Swiss bank, cut its Seagate Technology Holdings plc holding. Zurcher Kantonalbank Zurich Cantonalbank sold 24,272 Seagate Technology shares in the fourth quarter of 2018, reducing its holdings by 43.7%.

Zurcher Kantonalbank owns 31,215 Seagate Technology shares worth $1,642,000, according to its SEC filing. several investors may regard this move as a gloomy indicator for Seagate Technology’s future, but there are several reasons why an investor may cut their holdings.

Seagate Technology’s quarterly earnings announcement was lackluster compared to Wall Street expectations. The data storage company reported negative $0.28 EPS, $0.49 below the consensus estimate of $0.21. However, Seagate posted an EPS of $1.65 in the same period last year, which is a steep drop from previous heights, although the reasons for such drastic performance changes are unclear.

Seagate Technologies’ Q1 2017 revenue declined roughly one-third to $1.86 billion, below analysts’ expectations of $1.98 billion.

Investors like Zurcher Kantonalbank Zurich Cantonalbank may downsize to reduce risk or avoid negative surprises in light of these disappointing results and other information they have received internally or from equity research analysts outside their firms. Any investor’s position adjustment may not indicate a reduction in Seagate Technology’s business fundamentals and profitability.

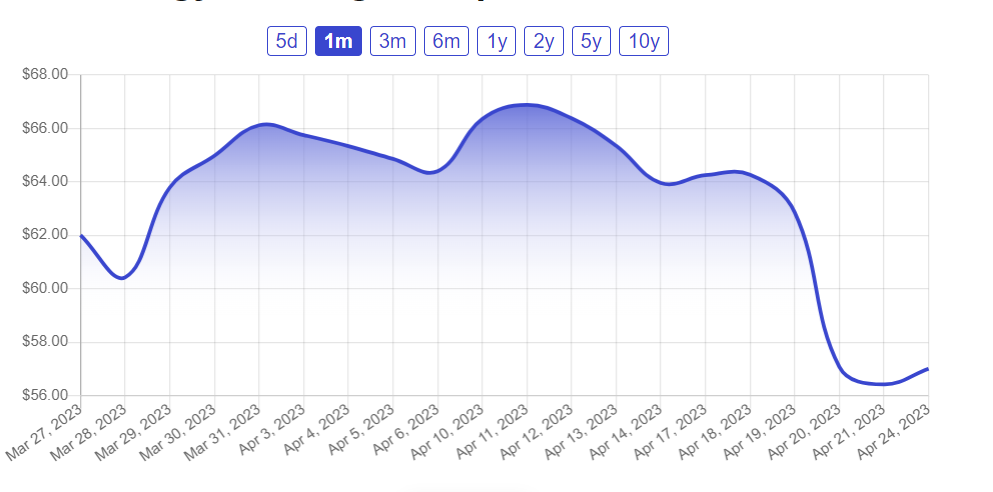

Rosenblatt Securities, for instance, rates Seagate Technology shares “buy” with a $70.00 target price. 32 Bloomberg-polled equity analysts gave the stock an average “hold” rating. Seagate Technology’s average price target is $65.76.

Seagate Technology’s financial performance this year depends on market conditions. However, traders and investment professionals across industries continue to analyze changes in positions by stakeholders who hold major shares in firms like STX to better gauge their own views toward company performance and market developments.

Hedge Funds Like Seagate Technology Holdings Despite Market Concerns

Several significant hedge funds increased their shareholdings in Q4 2020 because to Seagate Technology Holdings’ market dominance. Cowen Prime Advisors LLC increased its Seagate stake by 3,666.7% to 5,650 shares worth $297,000. AustralianSuper Pty Ltd acquired 869,693 Seagate shares worth $45 million, up 48.4%.

CWM LLC bought 3,794 Seagate shares worth $200,000, increasing its stake by 29.7%. Cornerstone Investment Partners LLC bought another 15.6% of Seagate value, totaling 26,886 shares worth $1.4 million.

Janney Montgomery Scott LLC bought 105,680 Seagate shares worth $5.56 million during the same period.

According to Bloomberg, Seagate Technology has an average rating of “hold” and a price target of $65 per share. Bank of America analysts rated STX stocks “buy” with a target price of $65.

Seagate’s -333% dividend payment ratio worries investment researchers about its future profitability. Post-record date on Wednesday June 21st, stockholders will get $0.70 per share on July 5th.

Recently, Jeff Nygaard sold 36,809 Seagate EVO shares for $2.54 million.