Monday afternoon stock market indexes rose around their highs. Norwegian Cruise Line (NCLH) broke out, at least temporarily, after earnings. JPMorgan Chase (JPM) rescued First Republic Bank (FRC).

Despite over 99% of voting pilots supporting a strike to secure a new contract, American Airlines (AAL) rose 2.2%. Shares surpassed the 21-day exponential moving average.

The talks precede summer travel. According to Dow Jones Newswires, federal legislation makes airline union strikes impossible.

Since the pandemic, air traffic has increased, causing salary and working conditions issues. Allied Pilots Association represents 15,000 American Airlines pilots.

United Airlines (UAL) rose 1.8% and Delta Air Lines (DAL) 1.9%.

Cruise Stocks Rise

Norwegian rose 8% after a smaller-than-expected Q1 loss on stronger sales. Shares rose over the 200-day line and stayed near highs into midafternoon. Bullishly, NCLH shares traded over 100% typical daily volume in the first 2-1/2 hours of Monday’s session. As it repays its massive Covid debt, demand is high.

Norwegian earnings will rise 118% in 2024. NCLH stock leads the S&P today.

Sympathy lifted Carnival (CCL) 3.5%.

The Dow rose 0.3% and the Nasdaq 0.1%. S&P 500 rose 0.3%. The Russell 2000 gained 0.2%, matching the major indexes.

Nasdaq stayed above 12,000. NYSE and Nasdaq volume decreased from Friday.

Invesco QQQ Trust ETF (QQQ) gained 0.2%, while Innovator IBD 50 ETF (FFTY) gained 0.5%.

Crude fell 2.5% to $74.89 a barrel. Gold futures fell 0.4% below $2,000.

Bitcoin fell 3.7% to $28,385. Coinbase (COIN) lost 6.9% with crypto.

May Day closed European and most Asian markets.

April’s ISM manufacturing index was 47.1, up from March’s 46.3. Manufacturing has contracted for six months.

Economic Data Due

3.56% was the 10-year U.S. Treasury yield. The CME FedWatch algorithm predicts roughly 90% probability of a quarter-point rate hike at the Fed meeting this week. If the Fed pauses rate hikes is the million-dollar question.

The FOMC begins its two-day meeting on Tuesday, with the rate hike decision scheduled for Wednesday at 2 p.m. ET. Fed Chairman Jerome Powell holds a 2:30 ET press conference.

Tuesday brings the March JOLTS job openings survey and factory orders, while Wednesday brings the April ISM Services Index.

After March’s 236,000 increase, Friday’s April jobs report is predicted to rise 175,000.

JPMorgan Rescues Stocks

After the public lost faith in the banking system and massively withdrew from banks, Mr. J.P. Morgan saved the failing bank industry in 1907.

JPMorgan rescued the weekend as it did 100 years ago.

JPMorgan bought most of First Republic Bank’s assets, including its $92 billion in deposits, after the FDIC seized the California bank. The bank will buy $173 billion in loans and $30 billion in securities.

Silicon Valley Bank and Signature Bank failed before this. Only Washington Mutual’s 2008 financial crisis collapse was larger.

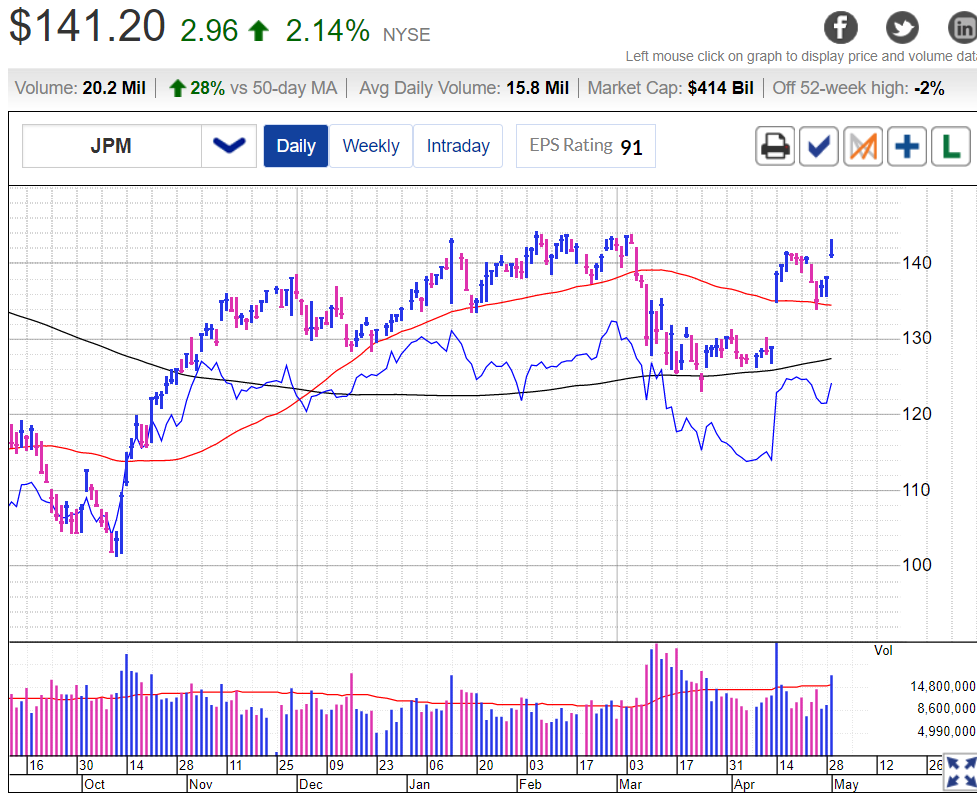

JPM, the Dow leader, surged 2.5% in heavier-than-average day volume on the news. The bank shares struck the cup-with-handle base purchase point at 141.88 and is in the 5% buy zone at 148.97.

Aerospace Stock Hits Buypoint

Following Thursday’s better-than-expected Q1 earnings and sales, Bel Fuse (BELFA) added 1.7% to last week’s 21.6% gain. The electrical circuit maker’s profit jumped 268% and sales 26% over the previous year’s quarter.

Shares reached the 44.40 buy point of an unclear base earlier in the session but fell below it.

This year, analysts estimate 15% earnings growth and 1% next year. The blue dot on the charts indicates a new relative strength line high.

Howmet Aerospace (HWM) climbed 1.2% and hit the 44.47 purchase point. MarketSmith pattern recognition puts aircraft and transportation firm shares in the purchase zone at 46.69.

Howmet announces Q1 earnings Tuesday morning.

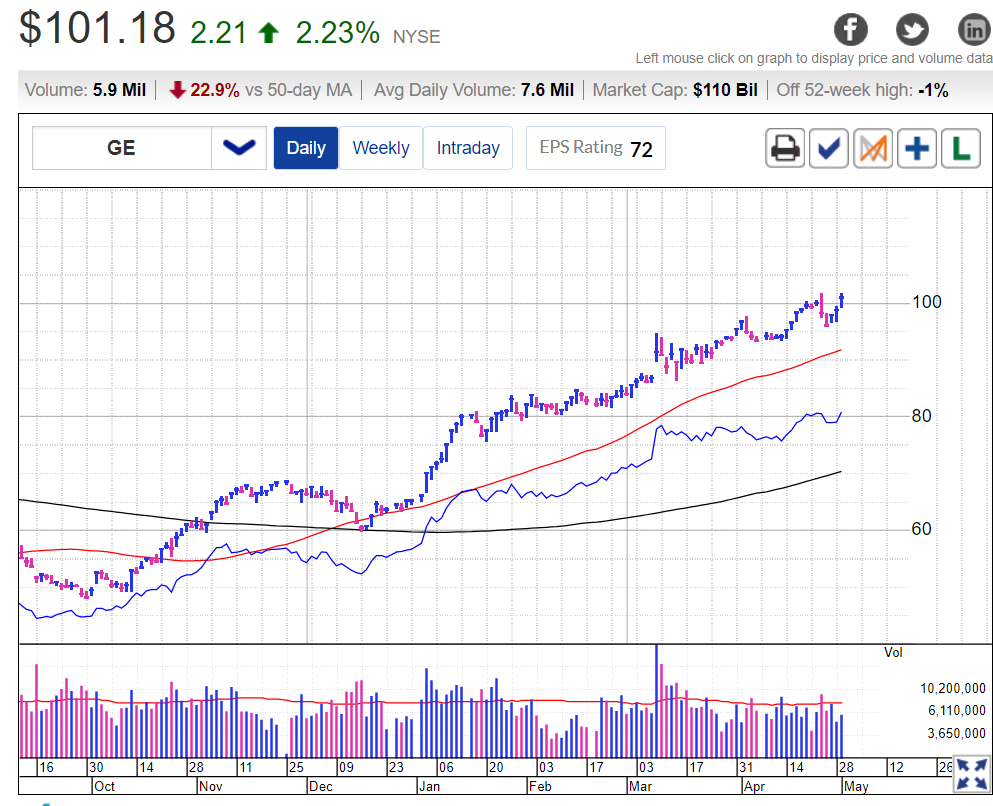

GE rose 2% to a five-year high. Shares have risen 54% this year, riding the 21-day line.

On Semi (ON) rose 7.2% after posting better-than-expected Q1 earnings and sales. Q2 earnings and revenue guidance exceeded analyst expectations.

“We continued our momentum with first quarter results exceeding expectations despite macroeconomic uncertainties,” said On Semi CEO Hassane El-Khoury.

The automotive chip stock retook the 21-day exponential moving average on the climb.

After announcing a 516% year-over-year growth in April vehicle deliveries, Li Auto (LI) slipped from early morning gains, up 0.4%. Its 25,681 deliveries were a record and the second month over 20,000.

Chinese EV maker’s shares rose over the 50- and 200-day lines.

Check Point (CHKP) fell 3.8% after beating Q1 profits but missing sales projections.

After Astellas Pharma (ALPMY) bought ophthalmology company Iveric Bio (ISEE) for $40 per share, the stock rose 15%.

China’s Gaming Revenue Soars

Wynn Resorts (WYNN) rose 2.5% after the Macau Gaming Inspection and Coordination Bureau announced a 450% increase in April gross revenues. In April 2022, Covid lockdowns in Asia dropped it 68.1%. Las Vegas Sands (LVS) climbed 1.7%.

ExxonMobil (XOM) slumped 2.9% after Goldman Sachs downgraded it to neutral from buy with a price target of 125.

RBC dropped its XOM price objective to 125 from 135 and maintained its outperform rating, while Morgan Stanley boosted it to 122 and maintained its overweight rating.

After Morgan Stanley upgraded GM to overweight from equal weight and raised its price target to 38 from 35, heavy volume rose 2%.