The reduction in daily FX purchases by Norges Bank last week fell short of expectations and exacerbated the weakened krone. A well-telegraphed 25bp rate hike this week and a larger reduction in FX purchases are necessary moves for the Bank to assist NOK, but external factors remain crucial, and we believe a sustained NOK recovery will not be a story until 2H23.

A predictable 25bp increase this week

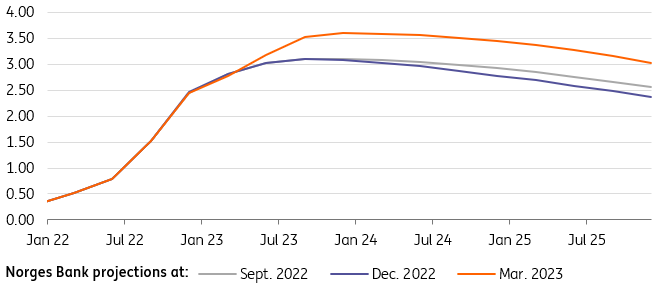

The Norwegian central bank is expected to raise interest rates by 25 basis points on May 4, bringing the policy rate to 3.25 percent. This should not come as a surprise, given that this is precisely what policymakers told us they intended to do last time. In addition, they anticipate another increase in interest rates in June, and March’s projections indicated a remote possibility of a similar move later in the year.

The motive is reasonably evident. The Norwegian krone (NOK) was 7% weakened on a trade-weighted basis by the March meeting compared to the beginning of the year. Combined with some concerns regarding recent wage data, this was sufficient to prompt a substantial upgrade to Norges Bank’s rate forecasts.

Since then, the “big picture” has not changed significantly. The Bank generates its interest rate forecasts in a fairly mechanical and transparent manner, and the significant variables have not changed significantly.

The trade-weighted NOK is marginally weaker than the Bank’s previous forecast. Oil prices are marginally higher across the curve, but not by a significant amount. Moreover, core inflation matched Norges Bank’s recent projections.

This week, there are no new forecasts, and the Bank is likely to do little more than indicate its intention to raise rates again in June. Further NOK depreciation and additional hawkish repricing among major economies could persuade Norges Bank to take an additional step later in the year.

With a US recession on the horizon and our prediction of significant Fed rate reduction by the end of the year, we are confident that the tightening cycle will likely end in June.

Norges Bank interest rate forecasts

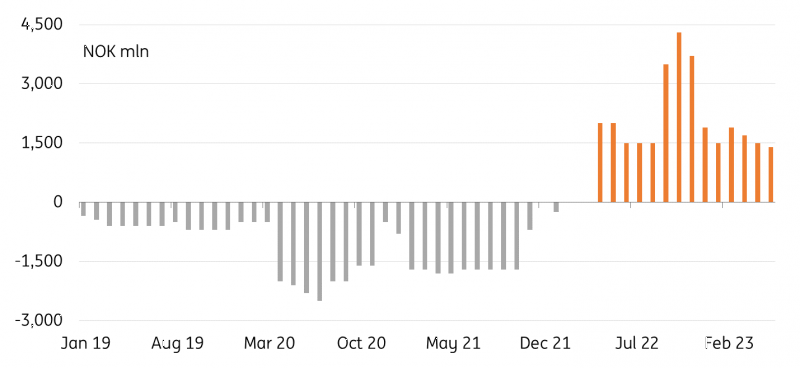

The markets anticipated greater cuts in daily FX purchases…

Some factors contributing to the krone’s depreciation are beyond Norges Bank’s control, including the recent market turmoil and reduced liquidity conditions in FX, which struck NOK especially hard given that it is the G10’s least liquid currency. At the same time, it can be argued that certain Norges Bank instruments are impeding NOK’s recovery.

In November, we argued for a decline in Norges Bank’s daily FX purchases as a tool to support a domestic currency that was already underperforming. This has indeed transpired, albeit at a slower rate than the markets would consider to be genuinely supportive of the currency.

The NOK’s markedly negative reaction to last week’s announcement of a further reduction of daily FX purchases from NOK 1.5 billion to NOK 1.4 billion, which were likely deemed insufficient, is illustrative.

Norges Bank daily FX transactions

but external factors are the primary influencers

In our opinion, external factors remain the preponderant factor for NOK. Despite disappointing market expectations, the reduction in daily purchases is a supportive factor for NOK, and while a sharper reduction in FX purchases – which may well materialize around a government budget revision in June – would be welcome, it would not be enough to compensate for the krone’s unfavorable external environment.