JPMorgan assists in the rescue of First Republic Bank, China’s manufacturing industry contracts once again, and investors believe that following Warren Buffett will be a market-beating strategy. — Sofia Horta e Costa

First Republic is doomed

JPMorgan will absorb all deposits held by the troubled First Republic Bank following its takeover by US regulators. The resolution followed an emergency auction over the weekend in which institutions including JPMorgan, PNC Financial Services, and Citizens Financial were required to submit bids.

Bank of America and US Bancorp were also invited, but neither decided to bid. JPMorgan, the nation’s largest bank, had an advantage in the government-led effort to sell First Republic due to what CEO Jamie Dimon terms its “fortress balance sheet.”

China endures

China’s factories are battling declining global demand. April purchasing managers’ indexes indicated an unexpected decline in factory activity, marking the first time this year that the indicator falls below 50. New orders, new export orders, and manufacturing employment sub-indices were all in contraction territory.

According to analysts, China’s economic recovery is at risk of losing momentum, with the figures increasing pressure on the government to increase policy support. The Politburo of the Communist Party, the highest decision-making body commanded by President Xi Jinping, recently stated that domestic demand remains insufficient.

However, evidence that consumers are traveling across the country and overspending during the month of May may provide them with a measure of relief.

Buffett as a Rival

Want to outperform the U.S. market? According to the most recent MLIV Pulse survey, both professional and retail investors recommend following legendary investor Warren Buffett. Over fifty percent of the 352 respondents anticipate that Berkshire Hathaway will outperform the S&P 500 over the next five years.

According to 80% of investors, Buffett’s strategy of purchasing shares for less than they are worth will be the Berkshire chairman’s greatest legacy.

In response to the respondent’s recent trip to Japan, respondents concurred that the country offers value but were divided on whether Japanese stocks will outperform those of the United States.

Quiet markets

After a subdued session in Asia, US futures are unchanged, while Treasuries are drifting lower. The majority of Europe was closed for business on May 1 in observance of the holiday, as were markets in Hong Kong, Singapore, and mainland China.

Finally, Joe’s morning curiosity.

Good morning. Economic news is key this week amid economic uncertainty. This week should clarify things. It’s a joke. Never understand.

However, Wednesday’s Fed decision is expected to raise rates by 25 bps. After that, nobody knows. According to Steve Matthews and Rich Miller, the FOMC is becoming increasingly divided about what to do next.

Understandable division. As with the economy all year, you can tell many stories.

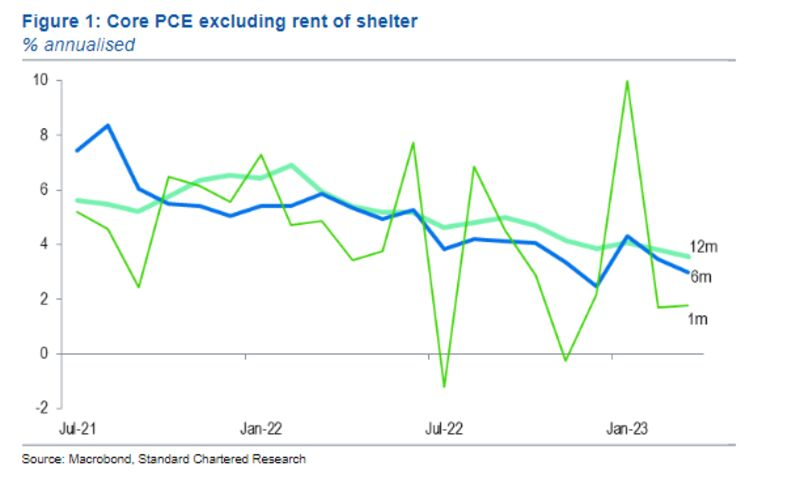

Inflation remains high. As Standard Chartered’s Steven Englander noted this weekend, core PCE ex-rent of shelter, a key indicator, continues to fall.

“There is nothing here to hang your hat on and conclusively say, in the words of Federal Reserve Governor Christopher Waller, that inflation is “meaningfully and persistently” on track to 2%,” says SGH Macro’s Tim Duy. Two more months like March, with core PCE inflation below the Fed’s year-end prediction, would help meet that condition.”

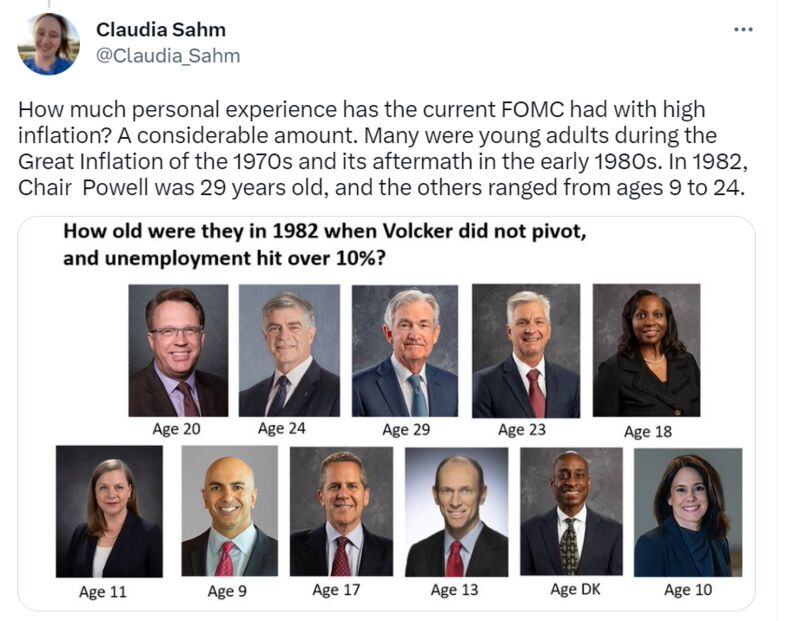

BTW, Claudia Sahm’s post on why she doesn’t expect a shift even if unemployment rises is great. The TLDR is that Fed officials now remember Arthur Burns and Paul Volcker (or their popular historical conceptions).

So inflation. Elsewhere, ambiguity abounds.

In recent weeks, the Philly Fed, Richmond Fed, and others have reported poor manufacturing data.

Though strong, headline labor market measures are slowing. Watch for evidence of white collar layoffs and “permanent job losers” rising. Preston Mui’s Employ America article is good. Again, absolute levels are fine. But all recessions start somewhere, so watch any derivative of labor market weakness.

Labor marketplaces. Last week, I read quarterly conference calls to see what management thought about inflation. Multiple companies mentioned how hiring has gotten easier. This doesn’t mean the unemployment rate will skyrocket. This is easing.

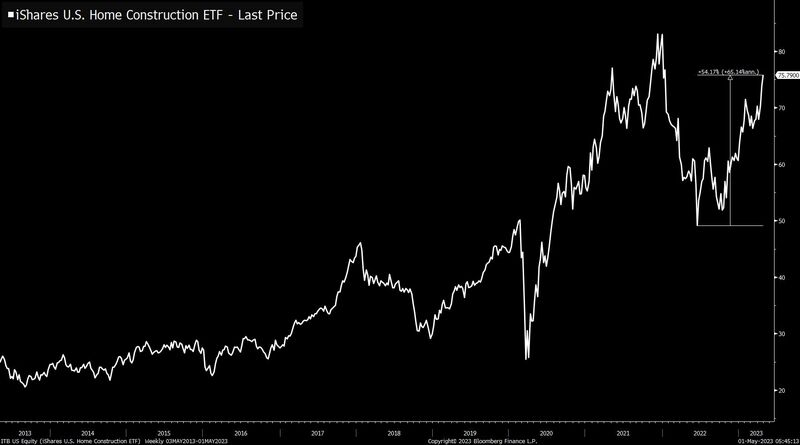

Housing is another major unknown. This was the area thought to be interest rate sensitive. Due to the Fed’s quick hikes last year, it appeared like it was headed into a downturn for a few minutes. ITB homebuilder ETF has risen 54% since last summer, putting it close to all-time highs.

Low inventories, a little increase in bidding wars, and other signs of life are reported again. According to the “housing is the business cycle” theory, a recession is unlikely.

Today is the newest ISM Manufacturing report, and Friday is the jobs report. Factory orders, auto sales, and more will follow. It’ll be an exciting week, albeit things will likely remain uncertain.