The extraordinary nickel short squeeze that drove nickel prices to $100,000 per tonne last year put nickel markets in the spotlight. The London Metal Exchange faced an existential crisis as the enormous surge quadrupled an all-time high in one morning. Xiang Guangda, the founder of Tsingshan Holding, the world’s largest nickel producer, maintained massive short bets in the nickel market, much like he did in the copper squeeze more than a century before.

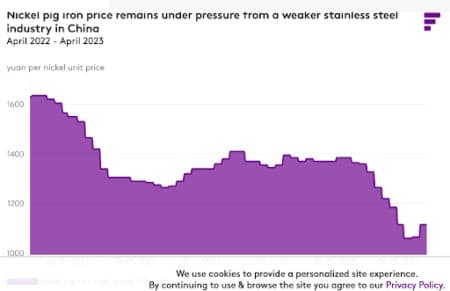

Now the nickel markets are crashing, but this time it’s the physical nickel markets, not nickel futures or a trader. Nickel prices have fallen 21% year-to-date to $23,300 per tonne due to a major supply surplus as Indonesian output outpaces global demand.

The International Nickel Study Group (INSG) predicts a supply-demand surplus of 239,000 tonnes, more than double last year’s 105,000 tonnes. In October, the organization predicted a surplus of 171,000 tonnes in 2023.

Global nickel demand will climb 6.1% in 2023, matching last year’s growth, but it won’t be enough to absorb Indonesia’s extra production.

USD/Tonne Nickel Prices

The World Stainless Association claimed that stainless steel output declined 5.2% in 2022, therefore nickel demand’s rise is surprising. The stainless steel sector consumes 75% of nickel production worldwide. After subsidy cuts and a shift to non-nickel chemistries, nickel demand has fallen due to China.

EVs are rapidly consuming nickel. Adamas Intelligence reported 17,137 tonnes of nickel used in EV batteries in February, up 19% month-on-month and 47% Y/Y.

The EV sector is growing fast, but it won’t be able to absorb Indonesian output. The country’s nickel mine output increased 48% to 1.58 million tonnes in 2022 and 44% in the first two months of this year, according to INSG’s latest monthly bulletin. In 2020, Indonesia banned ore exports, therefore all mine output is now nickel products.

Some nickel grades are oversupplied. Indeed, while Class II nickel—less than 99.8% nickel—continues to grow rapidly, Class I nickel—the grade traded on the LME—has declined 28% this year to 40,032 tonnes, the lowest level since 2007.

Due to China’s imports of intermediate EV products replacing refined nickel, Shanghai registered nickel stocks are even lower at 1,496 tonnes. The benchmark cash-to-three-months spread contango has dropped from almost $200 per tonne in early April to $12, showing traders are becoming more negative about nickel prices.

Commodity Pullback

Nickel markets aren’t alone. After a booming bull market in 2022, global commodities markets have been pulling back in 2023, with the World Bank expecting the fastest decrease since the COVID-19 epidemic.

The bank expects commodity prices to decline 21% and energy prices to fall 26% in 2023. Brent crude oil is predicted to average $84 a barrel this year, down 16% Y/Y, while U.S. and European natural-gas prices will drop by half. In 2023, coal prices are forecast to decline 42% and fertilizer costs 37%, the greatest yearly drop since 1976. Fertilizer prices remain near their 2008-09 food crisis peak.

The World Bank estimates that food prices will fall 8% this year, but they will still be at the second-highest level since 1975, leaving more than 350 million people worldwide food insecure.